Me again!

Every year around February I start to get excited about Daylight Savings being right around the corner. In 6 short weeks the sun will be setting at 7:15 every evening and get a little later every day through June 20th, when it won’t set until 9:11PM. Hope springs eternal. . . And I hope the same can be said for the struggling Seattle condo market. There are the slightest signs that might be happening. . .

But first, I would be remiss if I didn’t mention the “traditional” single family home market in Seattle. You’ve probably already heard that in most neighborhoods in Seattle (and all of the suburbs) virtually every property with an asking price that’s somewhat reasonable is receiving multiple offers and many properties are selling for literally hundreds-of-thousands of dollars above the asking price. . . I don’t think I’ve ever seen the market for houses this hot. Not in 2006. Not even in Spring of 2017, which was absolutely insane. . .

I bring this up because I think it could actually help revive the market for condos. As I’ve discussed in previous monthly updates, the markets for all types of housing are intrinsically tied to one another. Renters (particularly apartment renter) often want to buy, but can’t afford a house, so a townhome may be a logical first step. Condo and townhome owners usually, eventually want more rooms, more bathrooms, and more space (both indoors and out). When there is an excess of demand and shortage of supply in on type of property, it lessens the pressure on the other types. In our case, the overwhelming demand for single family homes and extreme shortage of supply has had a direct effect on the condo and rental market. All of you who read my monthly updates are already aware that the condo market has been suffering since COVID started. But what you might not know is that the rental market has also suffered. As of October, According to Apartment List data, since the start of the coronavirus pandemic, rents in Seattle have plunged 14 percent, the third-most of any major city in the U.S. during that time.

Many in my industry (myself included) are beginning to suspect there may be a bubble in the Seattle single family home market. Lots of things could cause the bubble to pop. But one of them would be SFR prices exceeding what the average buyer can ever hope to afford, causing “traditional” SFR shoppers to fall back on townhomes, townhome shoppers to fall back on condos, and renters to just decide to keep renting. You could look at it like dominoes, but I prefer to look at it like a teeter-totter, with equal and opposite opposing forces pushing each other up and down. . . We’re already seeing SFR buyers getting frustrated, fatigued, and deciding to give up. Some will stay where they are, but others will settle for a “lower” form of home ownership (no offense to condo owners; we all know that condos have a lot going for them, particularly when it comes to an stress-free lifestyle, with no lawn to mow, no roof to replace, etc.).

For the sake of anyone who’s hoping to see stability return to the condo market, I believe we could be beginning to see the start of the trend I mentioned above. But it’s still too early to tell. . . Let’s take a look at the stats!

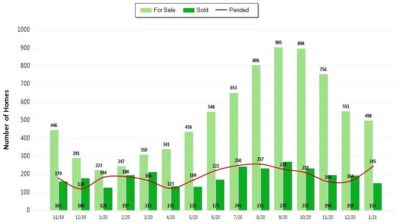

The number of condos for sale and the number of closed transactions both declined between December and January, but the number of “pended” properties was up pretty sharply:

More pending sales should result in a decline in inventory. Declining inventory should result in a stabilizing of prices (assuming demand stays the same). . .

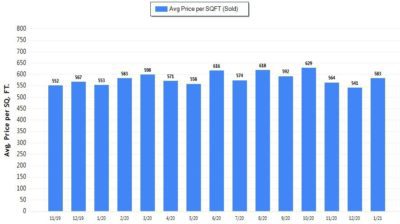

Perhaps most encouraging was an sharp reversal of the 2-month sharp downward trend in average $/ sq. ft.:

Far from being any sort of trend, it’s too early to know if this will continue beyond January (and stats for closed transactions in February won’t be out until March 1st). But it’s certainly better than a third month in a row with 4%-11+% declines!. . . So this could mean we hit the bottom in December and are on our way back up. But I’ll have a better idea in 28 days.

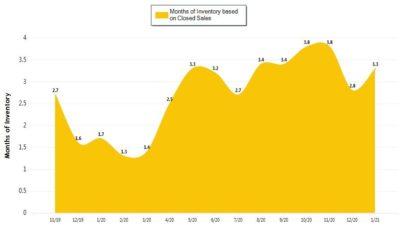

Average days on market was up in January, but only slightly. And the average sold price vs. asking price held steady at 95%. The only trend that seems a little problematic is a modest rise inventory:

| But it was a pretty modest rise, which I think will be offset by the increase in pending properties in January.

Anyway, this is far from the kind of data that should be considered a “call-to-action” for condo buyers OR sellers. For buyers it could mean the best time to buy is right away, but I’d feel more confident saying that if we saw genuine trends established. Of course by then it would be too late and the best time to buy would be a few months in the past. Sellers can either take their chances and hope the January data trends will continue throughout February and beyond. Or they can wait for definite signs of improvement, while we ALL hope the economy doesn’t collapse as a result of another GameStop-type shenanigan. ? So all-in-all, encouraging, but too early to tell. . . I know only one thing for sure. As long as the sun keeps rising, in 6 short weeks it’ll be setting a whole lot later. |

|

Until next month, Geoff |