Hello again!

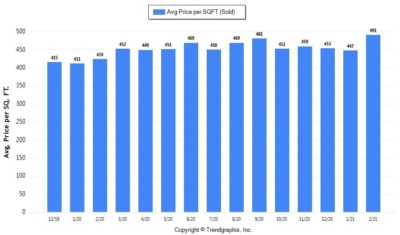

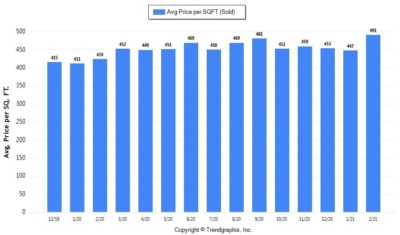

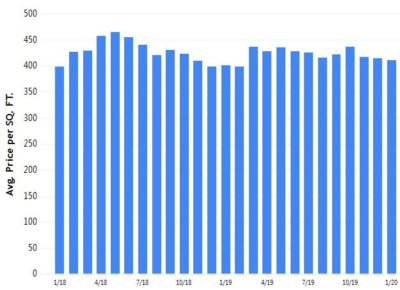

In my email update last month, I predicted we’d see a massive jump in closed prices for single family homes in Seattle in February, as the properties that went pending in January with 5, 10, 15, 20+ offers started closing. . . Unfortunately, not only was I correct, but I was more correct than I could’ve imagined. . . Average $/sq. ft. in February for single family homes spiked by a staggering 9.8%. IN ONE MONTH:

Buyers who also have “East Side”: communities in their search criteria should know that the trends we are seeing in Bellevue, Kirkland, Redmond, etc. are essentially identical to what we’re seeing in Seattle. And to a slightly lesser degree, the same can be said for Seattle bedroom communities to the north and south. . . In other words, it’s rough all over for buyers.

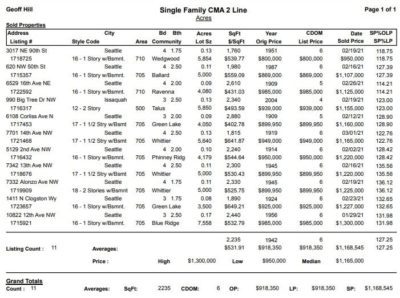

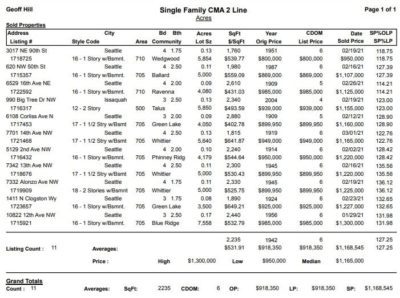

As if the (above) graph doesn’t illustrate the insanity of the market well enough, here’s another example. I have buyers who I was first in contact with in early January. They aren’t quite ready to shop yet, but wanted to begin learning about the market. So I set them up on a saved property search and asked them to “ping” me on properties they like. I have been saving all of their favorites in a “cart” on my side of the NWMLS portal. A few weeks ago, the first batch of properties they liked started closing and the final sales prices became public information. . . This is what that first batch of closed transactions looks like:

| The average property they liked sold for 27.25% over the asking price (EEEK!!!).

Of course this begs the question: why aren’t listing agents and sellers pricing their listings closer to what the market will bear? I’ve run the comps on most of these properties and there was no precedent for the kinds of prices these listings are achieving. The best comps supported values in the $900’s and most of them sold for $1.1-$1.2 million+. . .

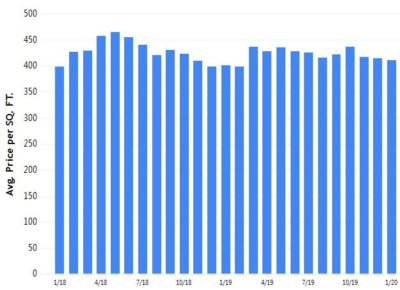

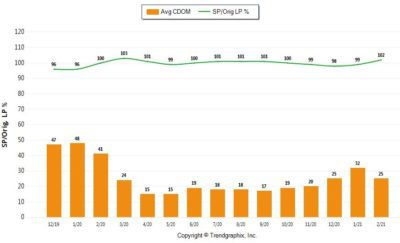

This looks like a bubble to me. I can’t say how long before the bubble bursts, but when I look back at the last few times we’ve had previously-unprecedented spike in prices, it was followed by fairly significant corrections. . . Check out what happened following the spikes in Spring of 2018 and March of 2019:

| Some of you may have heard that interest rates also spiked in the last 7-10 days, up half a point from the previous, all-time historic lows. Some believe this will dampen competition in the market. Personally, I’m concerned that buyers may redouble their efforts to find and buy homes as soon as possible, out of fear that rates may only continue going up. As with the future of the real estate market, I can’t predict what will happen with interest rates, but I do want to remind everyone that rates are still lower than they were 13 months ago. . . And anyone who’s a little older than I am might remember when rates hit 16.63% in 1981. I’m concerned that younger buyers may assume rates below 4% (or even 3%) are “normal”. Historically, they are not. For most of my 15 years in real estate, my buyers were thrilled to lock an interest rate of 4.75% or 5.25%.

And ultimately, prices and rates push and pull each other like the moon and the oceans. When money gets more expensive, buyers can’t afford to borrow as much of it. Sellers eventually realize that when buyers can’t afford to borrow as much money, they also can’t afford to pay the kinds of prices they could when money was very nearly free. So I don’t buy in to any of the “interest rate panic” that comes around every time rates go up. . . Everything will balance out with time.

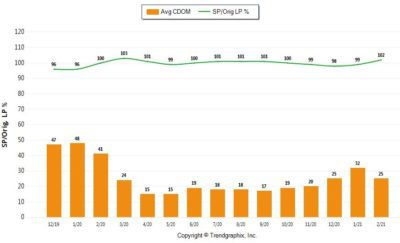

But in the meantime, no good news for active buyers. Average sale price vs. asking price was up and average days on market dipped:

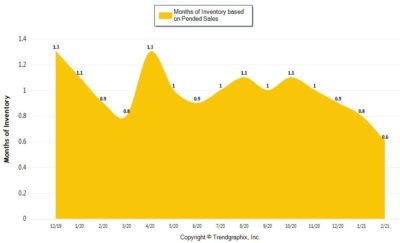

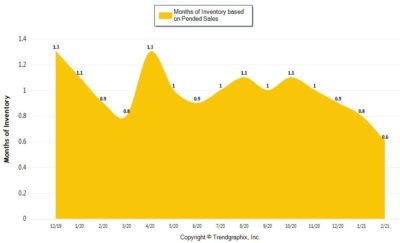

And although the number of new listings coming to market is increasing (as it always does as we approach Spring in the PNW), buyers are absorbing the new inventory faster than it can be replaced by new listings, leading to an overall decline in inventory in February:

| On top of the fever-pitch pandemonium in the market, the NWMLS decided to bless us with a number of major changes to the Purchase & Sale Agreement and various addenda we use. (Why they couldn’t have dropped these during the slow season is baffling). These changes take effect on Wednesday and I’ve been scrambling to understand, absorb, and mentally incorporate the changes into the advice I’ll be giving my buyers when it comes to making competitive offers. If any of you have two hours and forty minutes to spare and would like to become “varsity level” real estate consumers, you can learn all about the new changes here: NWMLS Rules Changes ??

This missive has been pretty buyer-centric and I should say something to my lovely sellers. So I will say this:

Sellers, I love you and I am so happy for you that you will be coming to market during such a fortunate time! Assuming we are successful in quickly selling your lovely homes to well-qualified buyers for extraordinary amounts of money, just be ‘vewwy, vewwy quiet’ as you tiptoe to the bank. . . There are a lot of angry, disappointed, and frustrated buyers in the city right now. ?? ?

Until next month,

Yours truly |

|

|

|