I doubt I’ll ever forget how 2021 ended for me. . .

Last Wednesday I drove over icy roads and made it to the University of Washington Medical Center, for my COVID booster shot. Aside from a sore arm, I felt great and enjoyed the Kraken hockey game in person that night. But around 4 in the morning I woke up in a cold sweat that no number of extra blankets could help. Of course I initially assumed this was just an adverse reaction to the booster shot. But after sleeping most of the day, when my breathing became labored and every 10 minutes I was expectorating liquid that was forming in my lungs (?) we thought this might be something more. We had a couple different home COVID tests. I tested positive twice in a row.

To be clear, I do not think I got COVID from my booster shot. I just had really horrible luck to have likely contracted the virus a day or two before getting my booster (and after 21 months of successfully avoiding getting the virus!). But I can’t complain. For one thing, the week between Christmas and New Years is nearly always dead in the real estate world. There really couldn’t be a better time of year for me to spend a few days in bed. And six days later, I’m finally nearly symptom free, with the exception of lingering lethargy and “brain fog”. But each day’s been a little better than the last, and now, with a double dose of booster PLUS natural exposure to the virus, I should be cruising into 2022 with a mega-load of antibodies! ?

Well then, back to business. . .

As many of you know, I’m probably the Seattle P.I. Real Estate Section’s biggest critic. Their data is always a few months behind and their commentary seems to tend towards extremes; either completely ignoring troubling issues in the market, or conversely, turning to sensationalism and fear-mongering to garner clicks and attention from an ever-shrinking audience. But I think this article they ran on Dec, 26th, despite a few hyperbolic statements, provides a fairly accurate summary of the year in review: Click Here. . .

Long story short, when it comes to the Greater Seattle market, it’s still a very rough time to be a Buyer.

I think the article does a great job of looking back at 2021, but I have to take issue with the article’s author, Anna Marie Erwert’s predictions about the future of the market. . . In the closing paragraph, she writes, “We predict more of the same in 2022. Unless the Feds drastically raise mortgage rates, unless suddenly supply outpaces demand, and of course, barring (another) unforeseen catastrophe, the Seattle market is unlikely to cool off in the coming year.”

We all know that an increase in interest rates or an influx of inventory would change things; but thanks for stating the obvious, Anna. Blatant hedging aside, I think it’s still a very bold statement to predict the market will not cool at all in 2022. In fact, I think the market is already cooling.

The article quotes a real estate blog published by Norada Real Estate Investments, a firm operating out of Laguna Niguel, California, sharing a building with an Albertson’s grocery store, a Western Union, and a Baja Fresh. According to Norada, in “the Eastside and Southeast King County map areas, prices jumped more than 26% from a year ago.”. . . Last time I checked, there isn’t really much of anything except forest in “Southeast King County” (unless you’re counting Lester, WA, population: ZERO ?):

Joking aside, I think Norada’s stats are pretty close. My own market stats, which were released on January 1st and include everything through December 31st, indicate a 23.2% increase in sold prices, year-over-year, for the 10 largest municipalities in King County, including Seattle. Bellevue was up 35.6%. Seattle, 13.7% (including a promising 5.8% decline between October and December). But what Ms. Erwert’s piece AND Norada’s stats fail to acknowledge is that in the cases of both Seattle AND the Eastside, nearly all appreciation occurred in the first half of the year, in both cases, topping out around April.

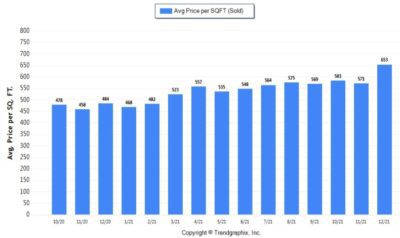

To illustrate, here is the average $/sq. ft. for single family homes on the Eastside over the last 15 months. (You can ignore the anomalously-high December stats, which are simply a reflection of the fact that only a few single family homes closed in all of December. It may also be a reflection of incomplete reporting of data, since this is the preliminary batch of data for December). Notice that with the exception of December, between April and November, average $/sq. ft. was only up 2.5%. . . That’s a far cry from the 26% or (36%) that the year-over-year stats are telling us!:

As we can see here, it mostly all happened between January and April, during which time average $/sq ft. leapt over 19%. It’s true that after that market conditions didn’t improve for Buyers, but they did not get significantly worse, either.

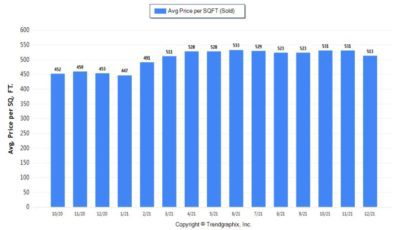

Here is the same chart for Seattle:

18.1% increase between January and April, then up only one half of one percent through November; and essentially unchanged if you include the “December dip”.

So with all due respect to Ms. Erwert and her esteemed strip-mall statisticians in Southern California, I think a more nuanced and granular approach is necessary in order to get a real sense about how the market is trending. Last year was really bad for Buyers (and no doubt it still is). But we haven’t seen a real “worsening” in market conditions since Spring. When Ms. Erwert says “we predict more of the same in 2022”, I take that to mean she predicts another year of double-digit price appreciation. I find that unlikely.

“Okay, Geoff. You’re pretty good at critiquing a ‘real estate journalist’ who describes herself as writing ‘from both the renter and new buyer perspective, having (finally) achieved both statuses’, but what are YOUR predictions, smart guy?”

Answer: I’m happy to oblige.

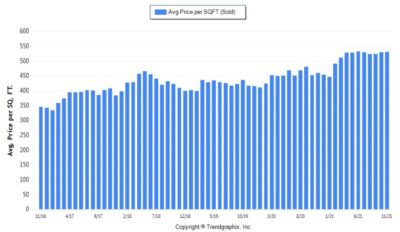

While there is no “Real Estate Law of Gravity” limiting how high prices can go, I think we can learn a lot from what the market’s done in the past. . . The first half of each of the last 5 years was marked by precipitous leaps in prices. That phenomenon has become so predictable, it almost feels like we can count on it. . . In 2017 and 2020, very little of the gains achieved in the first half of those years were sacrificed in the latter half of those years. But in 2018 and 2019, the huge “Spring Leaps” were followed by substantial declines in the second half of the year:

Now, admittedly, I’m no Norada. ? But it’s been over two years since the conclusion of our most recent extended downward trend (much longer than I previously expected the market to hold as strong as it has). I think we can attribute this to pent-up demand from COVID. But can it last forever? Omicron not withstanding, I suspect not. I’m going to make the following bold predictions, knowing full-well I could be completely wrong:

1. January starts off strong, with supply still extremely scarce and pent-up COVID demand still very much a factor. Multiple offers abound, inventory briefly dips below .2 months, average days on market falls below 14, and average sold price vs. asking price rises to 104% or higher. (Of course we will not see the closed sale stats for January pending sales until March 1st, which is frustrating).

2. In February, inventory begins to climb, but still doesn’t come close to matching demand. Asking prices climb, reflecting heightened (but unrealistic) Seller expectations. There are still multiple offers on most properties, but not as many as there were in January. Average $/sq. ft., which climbed moderately in January will show a slowing in February pendings (March closings).

3. By March, perhaps slightly sooner, we see a significant influx of inventory. Coupled with overpriced listings from January and February, still languishing on market, the market begins to show signs of seeking equilibrium. Price drops occur amongst the overpriced inventory and Sellers begin to feel a sense of urgency, as their Agents recognize that not every house is selling for 15% over the asking price in 8 days.

4. In April we reach a peak (as we have both Aprils the last two years). New inventory continues to come to market, as much of the last 2+ years of COVID demand finally begins to be satiated. Many Buyers and their Agents are still chomping at the bit, as nothing has (yet) to show them that prices are likely to correct. This bolsters demand, but only temporarily. Other Buyers, particularly those with savvy Agents, become more choosy. Fewer multiple-offer situations ensue and (although we can’t see it yet), the market is officially softening.

5. May, which is when we nearly always see the largest number of new listings, is when the power dynamic will finally shift in Buyers’ favors. Average sold prices may be 4%-8% higher in May than they are right now, but I doubt they will be any higher than that. Sellers and their Agents will be well aware that the “salad days” of lofty expectations and mind-blowing results are likely behind them. Some Buyers will recognize the opportunity and take advantage, locking in fair prices on quality properties. . . Other Buyers will rightfully wonder if this may not be the beginning of a true market correction, like the latter half of 2018, when values plummeted 14+% in just 7 months. Doubt in the marketplace could create a self-fulfilling prophecy. Whichever theory holds sway may carry the day, creating both the narrative and the prevailing market conditions for the second half of the year. . .

6. June-December – This far out becomes hazy for me. ?♂️ But I do NOT see much price appreciation in the latter half of 2022. It just never happens to any significant degree in our market. And after two plus years without a measurable correction, it feels like we’re overdue for one.

In summary (and sorry for this epically-long-winded, still-sick diatribe), I think Sellers’ sweet spot for listing their properties may be late-January through mid-April. Slightly earlier than the second week of May, which is historically, statistically the best time to list/sell in Seattle.

Buyers will need to balance their individual timelines with other factors, like how long the market remains competitive and whether or not they want to gamble on a market correction later in the year, keeping in mind the very-real possibilities that the FED may increase interest rates, while rising inflation is probably already taking a bite out of their purchasing power. . . Not to mention what may come as Omicron is rapidly yielding new peak daily infections and hospitalizations.

But listen to me, hedging my bets. I’m starting to sound like Anna from the Seattle P.I.!? Probably a good time to wrap this up and get some rest.

A CRAPPY NEW YEAR TO ALL FROM MY SICK BED!!! ✨??